Why do dentists need disability insurance?

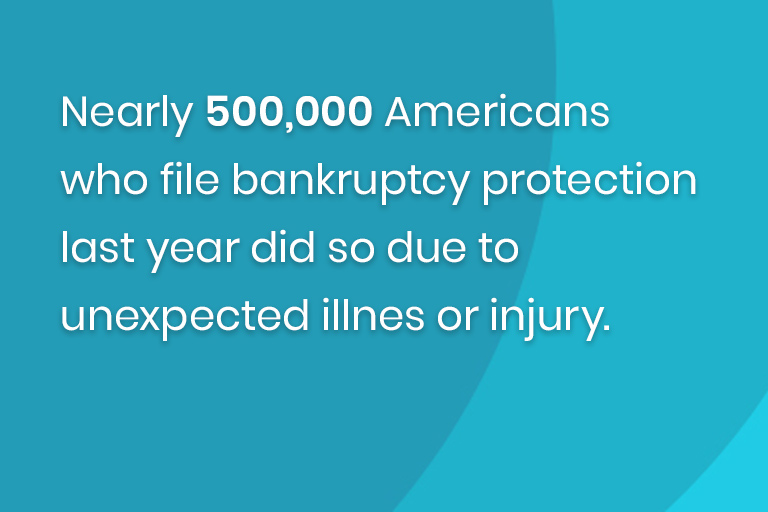

According to the Social Security Administration, 1 in 4 of American workers will suffer a disabling event at some point in their working careers that prevents them from working and earning income. That’s right, 1 out of 4 today’s 20 year-olds will become disabled at some point in their career. To avoid this risk and potentially lose income during this period of time, savvy dentists obtain disability insurance coverage to earn income while you recover.

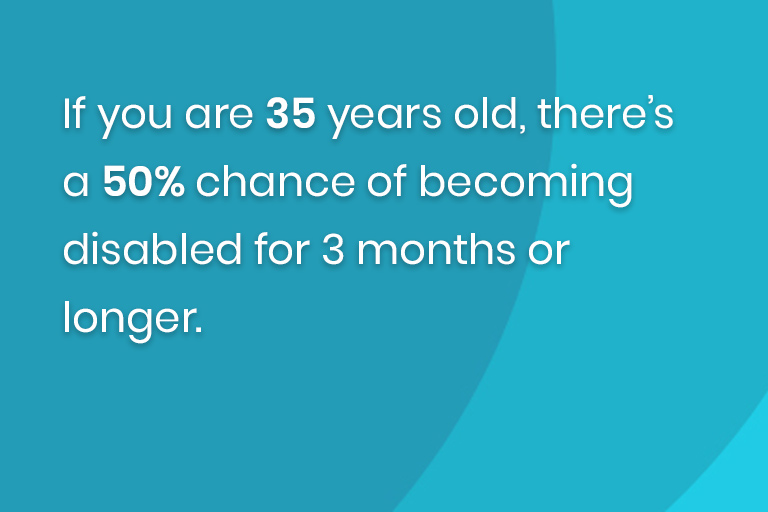

Your chances of missing a paycheck due to illness or injury are higher than you think. For example, if you’re 35 years old, there’s a 50% chance of become disabled for three months or longer. Can you imagine losing a paycheck for 3 months (or more) and the hardship that this will create?

That’s why securing disability insurance is a given for dentists.

When you purchase disability insurance coverage, you transfer the risk of losing your ability to earn income onto an insurance company rather than absorb the risk yourself. After the investment that you’ve made in educating yourself and the potential to recoup your investment, disability insurance is an obvious decision for dentist. Simply said, here are some questions that will illustrate why disability insurance is imperative for dentist.

- What would happen if you were unable to work for one year, or permanently?

- What would happen if you were prevented from treating patients?

- What would happen to you financially if you could not practice?

- What would happen if you were limited to half your workload?

- What if you were forced to work in a lower-paying specialty to compensate for your illness or injury?

As you know, most dentists have hundreds of thousands of dollars in student loans to repay. This debt does not go away because of an illness or injury. While you can refinance this debt, the debt remains.

Dentists are able to enjoy comfortable lifestyles due to the income potential to earn. However, your income potential rapidly diminishes when you can not practice what you are trained to do. Medical professionals have few to no options for alternate careers that will pay at the same level.

Medical professionals get paid to practice their specialty. With all that you have to lose, you should obtain disability insurance to offset a portion of this risk onto a larger insurance carrier who is better equipped to absorb this risk. Obtaining the right type of disability insurance will replace some of that lost income.

What type(s) of disability insurance should you obtain and how should you mitigate your risk?